Mileage Reimbursement For Remote Employees . learn how to deduct mileage when working from home and traveling for business. as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. Reimbursing mileage helps you drastically reduce. whether you shutter your central office or develop a hybrid wfh model, how will you administer your employee mileage. Find out the irs rules, state regulations, and tips for. in 'tax credits and relief', select 'your job' and then select 'remote working relief'. under those circumstances, employees’ residences essentially become their tax homes, and they may be. regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. To claim the relief for 2020 and 2021,.

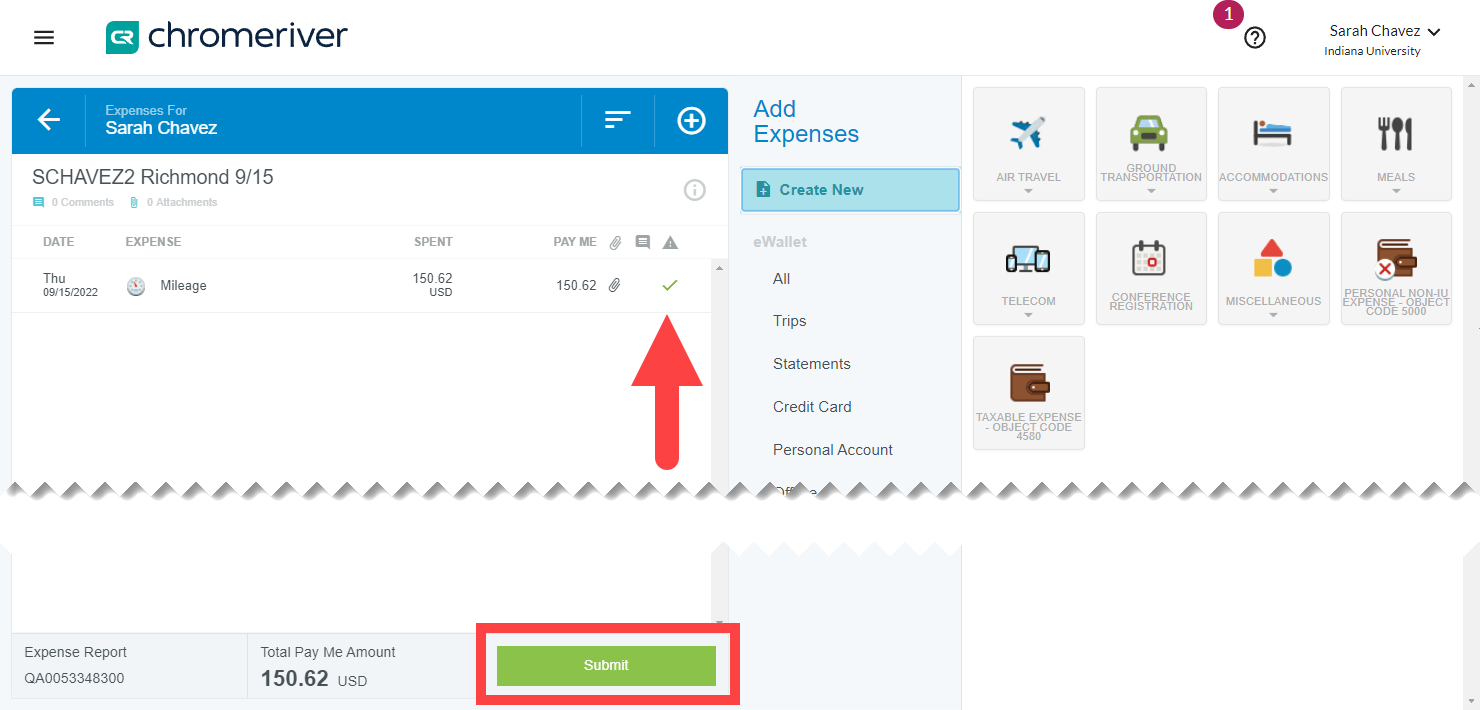

from training.iu.edu

regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. whether you shutter your central office or develop a hybrid wfh model, how will you administer your employee mileage. in 'tax credits and relief', select 'your job' and then select 'remote working relief'. Reimbursing mileage helps you drastically reduce. learn how to deduct mileage when working from home and traveling for business. as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. To claim the relief for 2020 and 2021,. under those circumstances, employees’ residences essentially become their tax homes, and they may be. Find out the irs rules, state regulations, and tips for. This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees.

Reimburse Mileage Reimbursing Travel Travel Documentation Financial

Mileage Reimbursement For Remote Employees This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. Reimbursing mileage helps you drastically reduce. under those circumstances, employees’ residences essentially become their tax homes, and they may be. learn how to deduct mileage when working from home and traveling for business. in 'tax credits and relief', select 'your job' and then select 'remote working relief'. regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. To claim the relief for 2020 and 2021,. Find out the irs rules, state regulations, and tips for. This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. whether you shutter your central office or develop a hybrid wfh model, how will you administer your employee mileage.

From kaass.com

How Does California Mileage Reimbursement Work? KAASS LAW Mileage Reimbursement For Remote Employees learn how to deduct mileage when working from home and traveling for business. To claim the relief for 2020 and 2021,. Find out the irs rules, state regulations, and tips for. regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. in 'tax credits and relief', select 'your job' and. Mileage Reimbursement For Remote Employees.

From contele.io

Contele Field Team Manager System Mileage Reimbursement For Remote Employees Find out the irs rules, state regulations, and tips for. under those circumstances, employees’ residences essentially become their tax homes, and they may be. in 'tax credits and relief', select 'your job' and then select 'remote working relief'. This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. as an employer, you. Mileage Reimbursement For Remote Employees.

From training.iu.edu

Reimburse Mileage Reimbursing Travel Travel Documentation Financial Mileage Reimbursement For Remote Employees This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. whether you shutter your central office or develop a hybrid wfh model, how will you administer your employee mileage. in 'tax credits and relief', select 'your job' and then select 'remote working relief'. as an employer, you can cover transportation costs by. Mileage Reimbursement For Remote Employees.

From hrdailyadvisor.blr.com

Tips for Reimbursing Employees’ Remote Work Costs HR Daily Advisor Mileage Reimbursement For Remote Employees in 'tax credits and relief', select 'your job' and then select 'remote working relief'. learn how to deduct mileage when working from home and traveling for business. Find out the irs rules, state regulations, and tips for. To claim the relief for 2020 and 2021,. under those circumstances, employees’ residences essentially become their tax homes, and they. Mileage Reimbursement For Remote Employees.

From training.iu.edu

Reimburse Mileage Reimbursing Travel Travel Documentation Financial Mileage Reimbursement For Remote Employees in 'tax credits and relief', select 'your job' and then select 'remote working relief'. whether you shutter your central office or develop a hybrid wfh model, how will you administer your employee mileage. This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. To claim the relief for 2020 and 2021,. Reimbursing mileage. Mileage Reimbursement For Remote Employees.

From www.rocketlawyer.com

Reimbursing Remote Workers for WorkRelated Expenses Rocket Lawyer Mileage Reimbursement For Remote Employees as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. Reimbursing mileage helps you drastically reduce. in 'tax credits and relief', select 'your job' and then select 'remote working relief'. This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. under those circumstances, employees’ residences essentially become. Mileage Reimbursement For Remote Employees.

From printableformsfree.com

2023 Mileage Reimbursement Form Printable Forms Free Online Mileage Reimbursement For Remote Employees whether you shutter your central office or develop a hybrid wfh model, how will you administer your employee mileage. This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. To claim the relief for 2020 and 2021,. Find out the irs rules, state regulations, and tips for. Reimbursing mileage helps you drastically reduce. . Mileage Reimbursement For Remote Employees.

From www.youtube.com

Expense Reimbursement Issues When Employees Are Working Remotely YouTube Mileage Reimbursement For Remote Employees in 'tax credits and relief', select 'your job' and then select 'remote working relief'. Find out the irs rules, state regulations, and tips for. regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. Reimbursing mileage helps you drastically reduce. learn how to deduct mileage when working from home and. Mileage Reimbursement For Remote Employees.

From www.pdffiller.com

Fillable Online Family and Friends Mileage Reimbursement Form Fax Email Mileage Reimbursement For Remote Employees in 'tax credits and relief', select 'your job' and then select 'remote working relief'. This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. under those circumstances, employees’ residences essentially become their tax homes, and. Mileage Reimbursement For Remote Employees.

From performflow.com

9+ Free Mileage Reimbursement Forms To Download PerformFlow Mileage Reimbursement For Remote Employees learn how to deduct mileage when working from home and traveling for business. Find out the irs rules, state regulations, and tips for. in 'tax credits and relief', select 'your job' and then select 'remote working relief'. as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. This manual explains the tax. Mileage Reimbursement For Remote Employees.

From falconexpenses.com

Car Allowance vs Mileage Reimbursement Mileage Reimbursement For Remote Employees Reimbursing mileage helps you drastically reduce. under those circumstances, employees’ residences essentially become their tax homes, and they may be. learn how to deduct mileage when working from home and traveling for business. whether you shutter your central office or develop a hybrid wfh model, how will you administer your employee mileage. as an employer, you. Mileage Reimbursement For Remote Employees.

From training.iu.edu

Reimburse Mileage Reimbursing Travel Travel Documentation Financial Mileage Reimbursement For Remote Employees under those circumstances, employees’ residences essentially become their tax homes, and they may be. regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. learn how to deduct mileage when working from home and traveling for business. in 'tax credits and relief', select 'your job' and then select 'remote. Mileage Reimbursement For Remote Employees.

From training.iu.edu

Reimburse Mileage Reimbursing Travel Travel Documentation Financial Mileage Reimbursement For Remote Employees This manual explains the tax treatment of reimbursement of travel and subsistence expenses to employees. learn how to deduct mileage when working from home and traveling for business. Find out the irs rules, state regulations, and tips for. Reimbursing mileage helps you drastically reduce. in 'tax credits and relief', select 'your job' and then select 'remote working relief'.. Mileage Reimbursement For Remote Employees.

From www.travelperk.com

2024 Mileage Reimbursement Calculator with HMRC Rates Mileage Reimbursement For Remote Employees regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. learn how to deduct mileage when working from home and traveling for business. under those circumstances, employees’ residences essentially become their tax homes, and. Mileage Reimbursement For Remote Employees.

From www.papertrails.com

Reimbursing remote employees Paper Trails Mileage Reimbursement For Remote Employees Reimbursing mileage helps you drastically reduce. learn how to deduct mileage when working from home and traveling for business. as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. in 'tax credits and relief', select 'your job' and then select 'remote working relief'. To claim the relief for 2020 and 2021,. . Mileage Reimbursement For Remote Employees.

From www.peoplekeep.com

Is employee mileage reimbursement taxable? Mileage Reimbursement For Remote Employees Reimbursing mileage helps you drastically reduce. under those circumstances, employees’ residences essentially become their tax homes, and they may be. as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. To claim the relief for 2020 and 2021,. learn how to deduct mileage when working from home and traveling for business. . Mileage Reimbursement For Remote Employees.

From www.bizzlibrary.com

Mileage Reimbursement Form for Easy and Quick Reimbursement Manage Mileage Reimbursement For Remote Employees Reimbursing mileage helps you drastically reduce. regardless of the distance and costs involved, remote employees can expect fair reimbursement for the expenses they. as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. To claim the relief for 2020 and 2021,. Find out the irs rules, state regulations, and tips for. under. Mileage Reimbursement For Remote Employees.

From www.sampleforms.com

FREE 9+ Sample Mileage Reimbursement Forms in PDF Word Excel Mileage Reimbursement For Remote Employees as an employer, you can cover transportation costs by reimbursing mileage or providing official vehicles. whether you shutter your central office or develop a hybrid wfh model, how will you administer your employee mileage. Reimbursing mileage helps you drastically reduce. under those circumstances, employees’ residences essentially become their tax homes, and they may be. Find out the. Mileage Reimbursement For Remote Employees.